FTSE 100 – BG (1009.25)

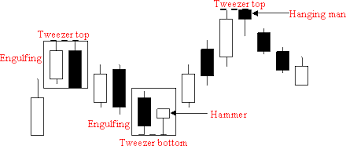

A tweezer top has formed at 1082 in candlestick chart as price resumes to drop. The position of daily momentum studies are also overbought with major indicators close to giving a sell signal soon. On trading below 1100 the target comes first at 1000 and thereafter at 950.

BG Group PLC operates as an integrated natural gas company. The Company explores develops, produces, liquefies, and markets hydrocarbons with a focus on natural gas. BG Group extends its services throughout global networks.

Open – 1,030.50

Day Range – 1,025.50-1,038

52WK Range – 808.8-1,300

Market Cap (B GBP) – 35.141

Shares Outstanding (B) – 3.418

Sector – Energy

Industry – Oil, Gas & Coal

Sub-industry – Exploration & Production

Tweezer patterns occur when two or more candlesticks touch the same bottom for a tweezer bottom pattern or top for a tweezer top pattern. This type of pattern can be made with candlestick charts of various types.

Read more: Tweezer Definition

Risk Warning

This does not constitute or form part of any offer for sale or subscription or solicitation of any offer to buy or subscribe for any shares nor shall it or any part of it form the basis or be relied on in connection with any contract or commitment whatsoever. Please note that William Albert Securities Limited does not enter into any form of contract by means of internet. William Albert Securities Limited (FCA 230691) is authorised and regulated, in the UK, by the Financial Conduct Authority (FCA).